you would be unduly prejudiced (or unfairly affected) if you are required to comply with the pre-action procedures.there are family violence allegations, or a risk of family violence.your case is urgent, for example where your ex-partner is about to sell or dispose of an asset.In limited circumstances, you may be exempt from following the pre-action procedures where: These steps are known are pre-action procedures. write to your ex-partner setting out your position and exploring options to resolve your dispute.

attempt some form of mediation or dispute resolution.

#Financial process for couples finances full#

#Financial process for couples finances how to#

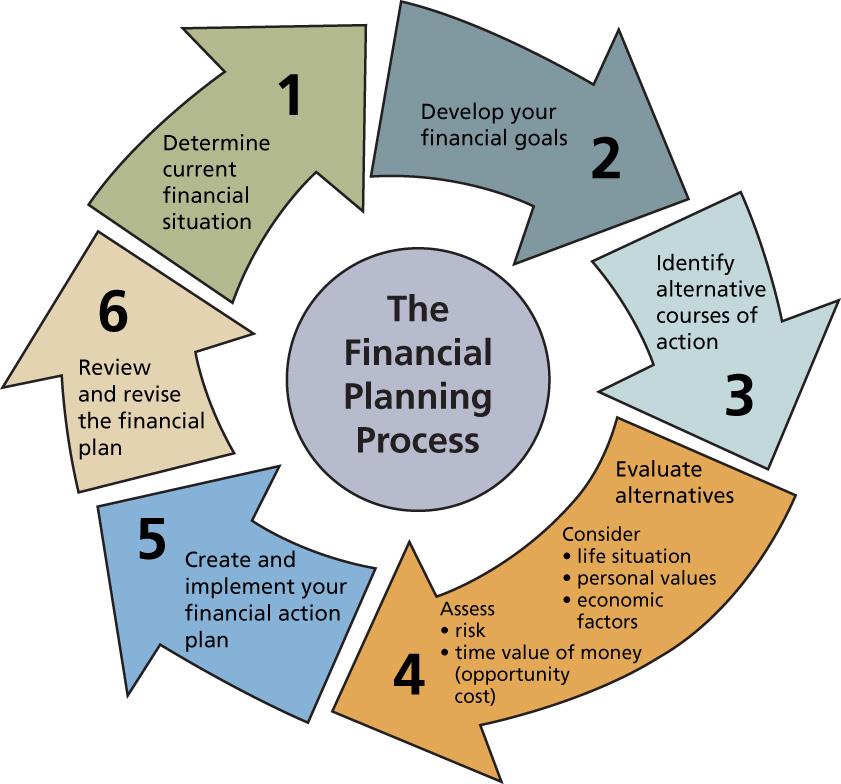

If you and your ex-partner can’t agree on how to divide your assets, you must make a genuine effort to resolve your dispute before you can apply for property orders. To find out what you might be entitled to in a property settlement without involved your ex-partner, you should: you and your ex-partners earning capacity.income, property, and financial resources.There are a range of factors that can be taken into account when considering you and your ex-partners futures needs, including: The final step in the process involves adjusting for the future needs of you and your ex-partner. direct and indirect non-financial contributions, for example, doing unpaid work in the family business.direct and indirect financial contributions, for example, contributing your wage or salary, or inheritances towards the assets.The second step involves assessing the contributions you and your ex-partner made toward the assets. The first step in the process is identifying and valuing the assets of the relationship. Instead, it provides a process for determining what percentage of the net value of your assets you are entitled to. The law doesn’t tell you what assets or what percentage of your assets you should receive in a property settlement. To ensure you reach a fair settlement, it is important that you and your ex-partner provide full and frank financial disclosure.įor more information, see Duty of disclosure on the Federal Circuit and Family Court of Australia website. stay or dismiss all or part of your case.adjust the property settlement in favour of your ex-partner, if they have provided full disclosure.refuse to allow you to use information or documents you didn’t disclose as evidence to support your case.If you don’t comply with your duty, a court can: It also covers any assets that have been disposed of in the year immediately before separation and since separation, that may affect, defeat, or deplete a claim. The duty covers all assets and debts that are in your name, or that are held by a corporation, trust, company, or other structure. You must disclose your total direct and indirection financial circumstances. In this process, you and your ex-partner have a duty to provide to each other with all the documents and information about your income, assets, debts, and other financial resources. This is done through the process of financial disclosure. The first step in negotiating a property settlement is to identify the property to be divided. were living in Australia when your relationship broke down.You must also have a geographical link to the Courts jurisdiction. one or both parties have made substantial contributions which would lead to serious injustice if any order was not made.your relationship is or was registered under a prescribed law of a State or Territory, or.you were in a relationship for least 2 years.You can negotiate a property settlement with your ex-partner partner where: how other people saw your relationship.whether you and your ex-partner own property together.the financial arrangements between you and your ex-partner.whether you and your ex-partner lived together, and if so, for how long.There are a number of different factors you can look at to determine whether you were in a de facto relationship, including: A de facto relationship is a domestic relationship between two adults who live together as a couple and are not married or related to each other.

0 kommentar(er)

0 kommentar(er)